In e-commerce, keeping track of every financial transaction is crucial for long-term success. One of the best tools for organizing finances is a chart of accounts (COA). A COA is a list of all the financial accounts in a business, carefully categorized to give business owners a clear picture of their income, expenses, assets, and liabilities. This structured setup helps track where the money comes in and goes out, which is essential for making sound financial decisions.

Creating a chart of accounts is particularly important for small and medium-sized e-commerce businesses. E-commerce businesses often handle numerous transactions daily, from sales and returns to fees for shipping, payment processing, and marketing. Managing all these transactions accurately can become very difficult without a clear system. A well-designed COA simplifies financial reporting and tax preparation and helps business owners understand their profitability more easily. It provides a solid foundation that supports both day-to-day management and long-term growth.

What is a Chart of Accounts for Ecommerce Business?

A chart of accounts (COA) is an organized list that categorizes a business’s financial accounts. Consider it like a guide that illustrates how money comes in and goes out. In a chart of accounts, each account is given a category, like assets, liabilities, income, or expenses, making it easy to see where funds are being spent and earned. This setup allows business owners to monitor their financial activities and quickly see how well their company is doing financially.

For e-commerce businesses, a COA has unique requirements. Unlike traditional stores, e-commerce businesses often manage multiple revenue streams, such as online sales across various platforms and credit card payments. They also handle unique financial elements like sales tax from different locations, which must be tracked accurately to avoid tax issues. Additionally, the costs for shipping, marketing, and managing a website all require separate accounts.

Setting up a chart of accounts that fits e-commerce needs helps make financial reporting easier, provides insight into the cost of goods sold, and streamlines accounting software usage. This organized approach saves time and reduces errors, which is essential for small and medium-sized e-commerce businesses aiming to grow successfully.

READ THIS ALSO: Outsourcing Accounting Services For Small Business

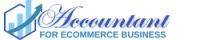

A. Benefits of Setting Up a Chart of Accounts

Establishing a clear and organized chart of accounts (COA) is highly beneficial for e-commerce businesses. Here are the key advantages:

1. Clear Financial Reporting

A well-structured COA organizes all financial transactions into specific categories, making tracking income, expenses, and profits much easier. Business owners get a complete financial picture by categorizing accounts like assets, liabilities, expenses, and revenue. Having clear financial reporting is essential for creating accurate financial documents, like the balance sheet and income statement, which provide important information about your business’s financial condition and growth.

2. Improved Tax Preparation

When taxes are due, a COA can simplify the process. With each account type organized, it becomes easier to identify deductible expenses, calculate sales tax, and separate accounts payable and accounts receivable. This structure reduces errors, making tax filing faster and more accurate.

3. Better Budgeting and Cost Control

A chart of accounts enables business owners to handle their budgets more efficiently. Tracking spending across different expense accounts makes spotting overspending and finding areas to cut costs easier. This budgeting assistance is especially useful for small and medium-sized businesses that need to monitor their cash flow and expenses closely

4. Informed Business Decisions

The detailed structure of a COA provides valuable insights into essential areas like cost of goods sold (COGS), profit margins, and operational expenses. By understanding these factors, business owners can better decide on pricing, manage inventory, and plan for future investments, leading to greater profits.

5. Efficient Use of Accounting Software

Accounting software is much more effective when paired with a detailed COA. Software like QuickBooks or Xero can automatically track financial data across separate accounts, streamline financial reporting, and even provide real-time updates on account balances. This automation saves time and ensures accuracy.

6. Enhanced Financial Transparency for Stakeholders

A clear COA helps provide transparency for stakeholders, investors, or partners by showing an organized view of financial health. This transparency builds trust and can be valuable when seeking investment or presenting financial information to others.

7. Reduced Errors and Misclassifications

With each transaction recorded in its proper account, a COA minimizes the risk of misclassifying income or expenses, keeping financial records accurate and reducing the likelihood of accounting errors that could affect business decisions or lead to potential tax issues.

Overall, setting up a COA provides a foundation for accurate, organized, and insightful financial management, essential for any e-commerce business aiming for long-term success.

RECOMMENDED: Why an Accountant is Important?

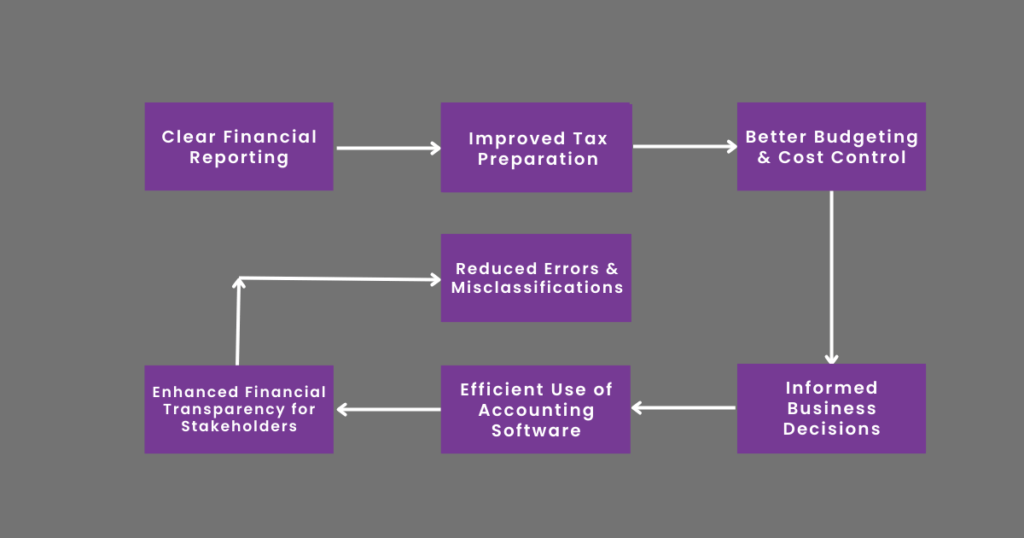

B. Key Components of a Chart of Accounts for Ecommerce Business

A chart of accounts (COA) for e-commerce includes several essential categories to organize finances effectively. Here’s a breakdown of the main types of accounts that small and medium-sized e-commerce businesses should set up:

1. Assets Accounts

Assets represent what the business owns. For e-commerce, these typically include:

Cash: The funds readily available for business expenses and investments.

Example: A business with $10,000 in its bank account is recorded under cash.

Bank Accounts: Accounts where funds are stored, such as checking or savings accounts, are important for tracking cash flow.

Example: A checking account holding $5,000 would be listed as a separate asset.

Accounts Receivable: Amounts that customers owe for products they bought on credit, indicating cash expected to come.

Example: If a customer buys $1,500 worth of merchandise but hasn’t paid yet, this amount is listed as accounts receivable.

Inventory: The value of products on hand needs regular tracking to ensure accurate financial reporting and inventory management.

Example: If an online store has 100 shirts valued at $15 each, the total inventory would be $1,500.

2. Liabilities Accounts

Liabilities are obligations or debts owed by the business. Important liability accounts include:

Accounts Payable: Money that you need to pay to suppliers for products or services bought on credit.

Example: If a business owes $2,000 to a supplier for recent stock purchases, this amount is recorded under accounts payable.

Sales Tax Payable: You need to send the sales tax collected from customers to the tax agency.

Example: If a business has collected $300 in sales tax from customers, this amount will be recorded as sales tax payable.

Loans: Any outstanding loans the business has, such as financing for inventory or equipment, essential for understanding the company’s debt load.

Example: A business has a $5,000 loan for purchasing a new computer, which should be documented under loans.

3. Equity Accounts

Equity shows how much the owner has invested in the business once you subtract what it owes (liabilities) from what it owns (assets). Key equity accounts include:

Owner’s Equity: The owner’s initial and additional investments in the business.

Example: If the owner puts in $20,000 to launch the business, this amount is noted as the owner’s equity.

Retained Earnings: Profits that are retained within the business rather than given to the owner, which can be used for growth or to pay for expenses.

Example: If the business made $10,000 in profit last year and reinvested it, it will be listed as retained earnings.

4. Revenue Accounts

Revenue accounts track the income the business earns. For e-commerce businesses, revenue accounts include:

Online Sales: The revenue generated from selling products on the company’s website or through various online platforms.

Example: If a business sells $50,000 of products monthly, this amount is recorded under online sales.

Returns and Allowances: A reduction in revenue due to product returns or discounts is important for accurate profit calculations.

Example: If customers return $2,000 worth of merchandise, this amount will be recorded as returns and allowances, reducing overall revenue.

5. Expense Accounts

Expense accounts help track the costs of running the business. Some of the usual expense accounts in e-commerce are:

Shipping Expenses: Expenses related to shipping products to customers.

Example: If the total monthly shipping costs amount to $1,500, this will be recorded under shipping expenses.

Marketing Expenses: Money spent on advertising and promoting the business, such as digital ads or influencer partnerships.

Example: If a business spends $3,000 on online ads, this amount will be logged as marketing expenses.

Merchant Fees: Fees charged by payment processors or credit card companies can add up with frequent transactions.

Example: If a business incurs $200 in merchant fees for processing payments, this will be categorized under merchant fees.

6. Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) is an important account for e-commerce businesses. It shows the direct expenses related to making or buying the products sold, which include costs for raw materials, packaging, and shipping from suppliers.

Example: If a business spends $20,000 on purchasing inventory it sells throughout the year, this amount will be recorded as COGS. Monitoring the cost of goods sold (COGS) is crucial because it affects profit margins and assists business owners in setting the right prices for their products.

By setting up these accounts in a COA, e-commerce businesses can better track their financial transactions, understand their expenses, and manage financial statements accurately. A well-organized COA provides a strong foundation for sound financial management, making growing and scaling confidently easier.

ALSO READ THIS: How Much Do Small Business Accountant Fees Cost?

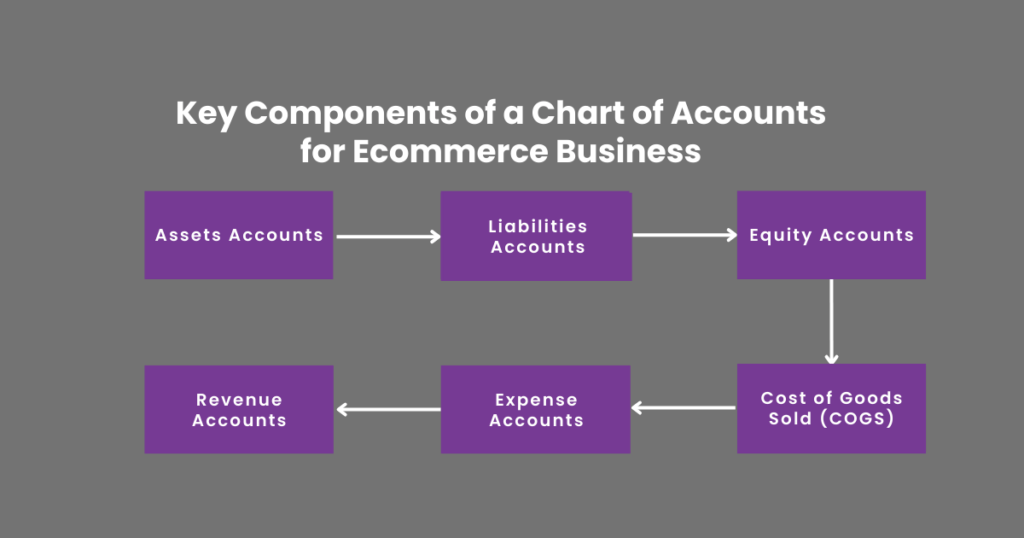

C. Setting Up Your Chart of Accounts for Ecommerce Business

Creating a chart of accounts (COA) for your e-commerce business is essential for managing your finances effectively. Here are some important steps to consider:

1. Numbering System

Using a numbering system helps organize accounts in a clear and structured way. For example, you might assign:

1000 series for Assets: All asset accounts, such as cash and inventory, can start with the number 1000.

Example: Cash accounts could be numbered 1001, 1002 for bank accounts, and 1003 for accounts receivable.

2000 series for Liabilities: All liability accounts can start with 2000.

Example: Accounts payable might be 2001, sales tax payable could be 2002, and loans can be numbered 2003.

3000 series for Equity: Owner’s equity accounts can start with 3000, with retained earnings as 3001.

4000 series for Revenue: All revenue accounts, including online sales and returns, can be numbered starting from 4000.

5000 series for Expenses: Expense accounts can start with 5000, categorizing different expenses such as shipping or marketing.

This numbering system lets you quickly find and reference specific accounts, making financial reporting more efficient.

2. Separate Accounts for Key Transactions

It’s essential to create separate accounts to track various financial activities. For example:

Income: Having distinct accounts for different revenue streams (e.g., online sales subscription fees) lets you see which areas perform well.

Example: An e-commerce business might have separate accounts for online sales (4001), affiliate sales (4002), and service income (4003).

Expenses: By organizing your expenses into clear categories like shipping, marketing, and administrative costs, you can see how your money is being spent and find areas where you might save.

COGS: Creating a specific account for COGS (5001) is crucial as it allows you to calculate profit margins accurately. Keeping track of the Cost of Goods Sold (COGS) separately allows you to identify the direct expenses related to the products you sell, which is crucial for setting prices and analyzing your finances.

3. Using Accounting Software

Implementing accounting software can significantly simplify the setup and maintenance of your COA. Many tools are designed for e-commerce businesses, offering features that help manage financial transactions seamlessly. Popular options include:

QuickBooks: QuickBooks is an easy-to-use software that lets you personalize your chart of accounts easily and includes features for invoicing, tracking expenses, and generating financial reports.

Xero: Known for its intuitive interface, Xero provides excellent support for e-commerce businesses, allowing integration with various online sales platforms.

Wave: A no-cost accounting tool ideal for small businesses, providing essential features for managing a chart of accounts, creating invoices, and tracking expenses.

Using these tools can help automate many accounting tasks, ensuring that your financial data is accurate and up to date. They also provide built-in reporting features, allowing you to generate important financial statements with just a few clicks.

Setting up your COA can create a strong foundation for managing your e-commerce business’s finances. A well-structured COA allows for clear financial reporting, efficient tax preparation, and better decision-making, all vital for growing your business.

ALSO READ THIS: Why is Accounting Referred to as the Language of Business?

D. Best Practices for Managing Your Ecommerce COA

Effectively managing your chart of accounts (COA) is essential for keeping your e-commerce business financially healthy. Here are some effective tips to help you maintain an organized and functional chart of accounts (COA):

1. Regularly Review and Update

As your online store expands, your financial requirements will evolve. Regularly reviewing and updating your COA ensures it aligns with your business structure.

Why It Matters: This practice helps you track new revenue streams, additional expenses, or changes in accounting regulations. For instance, if you expand into international sales, you may need to add accounts for foreign currency transactions or import taxes.

2. Keep It Simple and Consistent

A clear and consistent COA makes financial management easier. Keep things simple by reducing the number of accounts you set up.

Tip: Focus on major categories that reflect your business activities. For example, instead of having numerous specific expense accounts, you could group them into broader categories like marketing expenses and shipping costs. This approach helps you analyze your financial transactions without feeling overwhelmed.

3. Separate Personal and Business Transactions

Maintaining a clear distinction between personal and business finances is essential for accurate accounting.

Dedicated Business Bank Account: Open a separate bank account for your e-commerce business. This practice simplifies your financial reporting and makes tracking business income and expenses straightforward.

Business Credit Card: Use a dedicated business credit card for e-commerce-related purchases. This separation allows for better tracking of expenses and ensures that your financial statements reflect only business-related transactions, avoiding any confusion during tax season.

By following these best practices, you can effectively manage your e-commerce COA, which supports better financial reporting and decision-making. A well-maintained COA is a solid financial management foundation for your e-commerce business.

E. Common Mistakes to Avoid in E-commerce COA Setup

Setting up a chart of accounts (COA) for your e-commerce business can be straightforward if you avoid common pitfalls. Here are some mistakes to watch out for:

1. Overcomplicating the COA

One of the biggest mistakes is creating too many accounts or overly complex structures.

Why Fewer Accounts Are Better: A streamlined COA with fewer, well-organized accounts helps you understand your financial transactions more clearly. It prevents confusion and makes it easier to generate accurate financial statements.

Tip: Focus on essential categories, like income, expenses, assets, and liabilities. This approach will make tracking your financial performance simpler and more effective.

2. Neglecting Accounts Payable and Receivable

Failing to track accounts payable and accounts receivable can lead to significant financial issues.

Consequences of Poor Tracking: If you neglect these accounts, you may miss payments to suppliers or overlook money owed to you from customers. This oversight can disrupt your cash flow and lead to financial instability.

Solution: Regularly update these accounts and monitor them closely. Ensure you have separate accounts for tracking incoming payments (accounts receivable) and outgoing payments (accounts payable).

3. Ignoring Sales Tax

Many e-commerce businesses overlook the importance of tracking sales tax.

Importance of a Separate Sales Tax Account: Failing to keep a separate account for sales tax liabilities can result in underpayment or overpayment, leading to potential penalties from tax authorities.

Recommendation: Create a dedicated account for sales tax (e.g., Sales Tax Payable) within your COA. This setup will help you track sales tax collected from customers and ensure timely payments to the government.

You can set up a more effective COA for your e-commerce business by being aware of these common mistakes and avoiding them. A well-organized COA is key to accurate financial management and can help you make better business decisions.

Final Thoughts

In conclusion, establishing a chart of accounts for e-commerce business is essential for effective financial management. Organizing financial transactions into clear categories can enhance financial reporting, simplify tax preparation, and make informed business decisions. Avoiding common pitfalls, such as overcomplicating your COA and neglecting accounts payable and receivable, will ensure that your accounting practices support the growth of your e-commerce business. With a well-structured COA, you’ll be better equipped to navigate the unique challenges of e-commerce and achieve long-term success.