For small business owners, understanding small business accountant fees cost is crucial to maintaining financial health. While hiring a certified public accountant (CPA) can initially seem like an added expense, it often proves invaluable for navigating the complexities of business taxes and financial planning. This guide will explore factors influencing accountant fees, average costs, and strategies for optimizing your accounting approach.

Recent research, including the Dan Geltrude Report, highlights the USA’s significant shortage of accountants. This shortage has led to a surge in demand for accounting services, resulting in higher fees. As businesses scramble to find qualified professionals, understanding how to manage these rising costs becomes essential.

This guide will examine average salaries and the factors contributing to increased accountant fees. We will also discuss practical solutions for overcoming high rates. One effective strategy is to consider outsourcing accounting tasks to firms or professionals that offer competitive rates without sacrificing quality. This approach can help you maintain accurate records while effectively managing your budget.

By understanding the landscape of small business accounting and exploring options for cost-effective solutions, you can ensure that your financial health remains robust. Join us as we break down the nuances of accountant fees and equip you with the tools necessary to navigate this aspect of your business.

Factors Influencing Small Business Accountant Fees Cost

1. Type of Services Offered

The accounting services you require play a significant role in determining your overall costs. Common services include bookkeeping, tax preparation, and financial advice. Depending on your business’s specific needs, you may require specialized tasks such as tax planning or financial reporting, which can incur higher fees. A good CPA can provide a comprehensive package tailored to your business, ensuring that all accounting tasks are handled efficiently.

2. Complexity of Your Business Operations

Businesses that operate in multiple states manage various revenue streams, or engage in intricate financial transactions typically incur higher fees. This complexity can lead to more challenging business accounting fees because your accountant may need to invest additional time and expertise to ensure everything is compliant with regulations. On the other hand, a straightforward business structure generally leads to lower costs.

3. Quality of Financial Records

Accurate records are essential for effective accounting. If your records are organized, complete, and error-free, you can expect lower fees. However, if you have missing documents or disorganized files, your accountant may need to spend extra time sorting through them, ultimately increasing your accounting costs. Implementing reliable accounting software can help maintain accurate records and make the process smoother.

4. Fee Structures

Different accountants have varying fee structures. Some may charge an hourly rate, ranging from $100 to $400, while others might offer fixed rates for specific services—understanding how your accountant charges can help you budget more effectively. For example, the average legal expense for small business accounting can fluctuate based on the complexity of the service and the accountant’s location.

Average Costs for Small Business Accountant Services

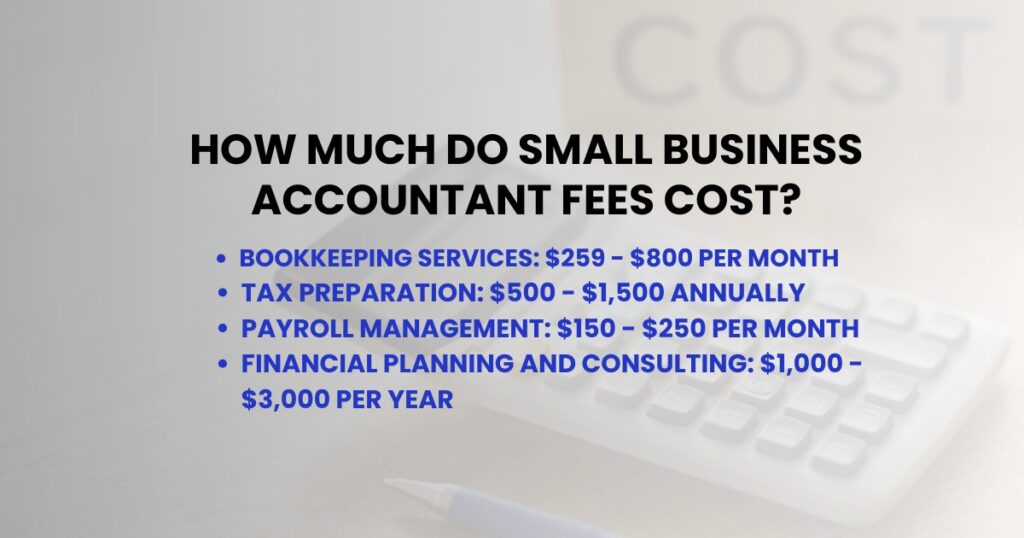

On average, small business owners can expect to pay between $1,000 and $3,000 annually for accounting services. Here’s a breakdown of the typical costs associated with various accounting functions:

- Bookkeeping Services: $259 – $800 per month

- Tax Preparation: $500 – $1,500 annually

- Payroll Management: $150 – $250 per month

- Financial Planning and Consulting: $1,000 – $3,000 per year

These estimates can help you gauge the average small business accounting fees, but actual costs will vary based on individual circumstances.

Why Hiring an Accountant Is a Smart Investment

While the costs associated with hiring a small business accountant can seem daunting, the benefits often outweigh the expenses. A qualified CPA can help you avoid costly tax filing mistakes and guide you through financial advice specifically tailored to your business situation. Without professional guidance, you might mismanage your business taxes, leading to penalties from the IRS.

For instance, small business owners often underestimate their tax liabilities, which can lead to fines and audits. The average amount owed during an audit can be staggering—often around $7,000 for mail audits and even higher for in-person reviews. A CPA can help you minimize the risk of these situations by ensuring that you meet all legal obligations and maximize any available deductions.

ALSO READ THIS: Why is Accounting Referred to as the Language of Business?

Tips to Lower Your Accountant Fees Cost

1. Maintain Accurate Records

One of the simplest ways to keep your small business accounting costs low is by maintaining organized records. Using accounting software can streamline the tracking of your income and expenses, allowing your CPA to focus on higher-value tasks. This organization can lead to lower hourly rates when your accountant can quickly assess your financial standing without sifting through cluttered records.

2. Use a Bookkeeper

If your accounting needs are primarily transactional, consider hiring a bookkeeper to handle day-to-day financial operations. This allows the CPA to focus on strategic activities, such as tax planning and compliance, thereby potentially lowering your overall costs.

3. Evaluate Fee Structures

As you consider hiring an accountant, it’s essential to understand their fee structures thoroughly. Ask potential accountants to explain their pricing models and what services are included. This clarity can help you avoid unexpected charges and better manage your overall accounting expenses.

4. Invest in Financial Strategy Development

While it may seem counterintuitive, investing in a tailored financial strategy from a CPA can lower your costs in the long run. A knowledgeable accountant can identify deductions or strategies that could save you money on taxes, making their services a worthwhile investment.

Conclusion

Understanding small business accountant fees cost is essential for making informed decisions about your financial management. While the costs can vary based on the complexity of your needs and the quality of your records, hiring a CPA can provide significant long-term benefits. You can manage your accounting expenses effectively by keeping your accounting tasks organized and maintaining accurate records.

Remember, a small business accountant is not just a cost but an invaluable resource for ensuring your business remains compliant, efficient, and profitable. Investing in a CPA can lead to substantial savings and peace of mind, allowing you to focus on what you do best—growing your business.

What are professional fees in accounting?

Professional fees in accounting are the charges that accountants or accounting firms apply for their services. These fees can change a lot depending on how complex the services are, the reputation of the firm, and where you are located. For small business owners, knowing these fees is important for proper budgeting. When you hire a bookkeeper or an accountant, you usually pay for different tasks, like tax planning, financial reports, and other services for small business accounting needs. On average, accounting fees can range from a few hundred to several thousand dollars each year, depending on the work required.

How much does a personal accountant cost?

The cost of a personal accountant can vary quite a bit based on your financial situation and the level of help you need. Personal accountants typically charge between $200 and $500 for basic services. If you need help regularly, the monthly fees can range from $100 to $400. Considering getting a personal accountant for your small business, consider the average accounting fees for various services for small business needs. Many small business owners find that working with a personal accountant helps them better manage accounting tasks, leading to smoother financial operations and possible tax savings in the long run.